Did you know that over 8 lakh Indians have chosen the HDFC Platinum Plus Credit Card for its unmatched rewards and benefits? This card is designed for discerning individuals who value both convenience and exclusivity in their financial transactions.

With the HDFC Platinum Plus Credit Card, you can earn reward points on every purchase, enjoy exclusive insurance coverage, and make utility payments effortlessly. Whether it’s dining out, shopping, or traveling, this card offers accelerated rewards that make every spend count.

What truly sets the HDFC Platinum Plus Credit Card apart is its tailored approach to meeting the needs of modern consumers. From high reward rates to comprehensive travel insurance, this card is a perfect blend of luxury and practicality. Plus, with HDFC Bank’s trusted service, you can be assured of a seamless banking experience.

In this article, I’ll share my personal insights into what makes the HDFC Platinum Plus Credit Card a standout choice. Whether you’re a frequent traveler or a smart shopper, this card is designed to enhance your lifestyle while offering exceptional value.

Key Takeaways

- Earn reward points on every purchase with accelerated rewards for dining and select websites.

- Enjoy exclusive insurance coverage, including accidental death and medical emergency benefits.

- Experience hassle-free utility payments and cash withdrawals with no charges.

- Benefit from HDFC Bank’s reliable service and tailored banking solutions.

- Enhance your lifestyle with a card designed for the modern, discerning consumer.

Overview of the HDFC Platinum Plus Credit Card

The HDFC Platinum Plus Credit Card has become a top choice for many Indians due to its excellent rewards and benefits. Designed to enhance your spending power, this card offers a blend of convenience and exclusivity.

Earning rewards is straightforward. You get 2 reward points for every ₹150 spent, with a 50% increase in points for amounts above ₹50,000 in a statement cycle. The application process is simple, whether you prefer doing it online or visiting a bank branch.

Key features of the card include:

| Feature | Details |

|---|---|

| Reward Points | 2 points for every ₹150 spent |

| Enhanced Rewards | 50% more points above ₹50,000 per cycle |

| Application Process | Easy online or offline application |

This card is perfect for those looking to maximize their rewards while enjoying a hassle-free banking experience.

Features and Benefits of the HDFC Platinum Plus Credit Card

Why do millions of Indians trust this card? It’s because of the exceptional benefits and features designed to make every purchase rewarding and secure. Let’s explore what makes this card a top choice for savvy spenders.

Earning reward points is simple and rewarding. You get 2 points for every ₹150 spent, and even more on dining and select purchases. Plus, with no hidden charges and a clear fee structure, you can enjoy an interest-free period of up to 50 days when you pay your balance in full.

Utility payments are a breeze with this card. The secure transaction process ensures your payments are safe and hassle-free. Whether it’s dining out or shopping online, every transaction is protected with state-of-the-art security features.

The fee structure is transparent, with minimal add-on card fees and a clear interest calculation. This makes it easy to manage your finances without unexpected charges. Plus, the application process is straightforward, both online and in-person.

These features and benefits are tailored for the modern spender, offering a perfect blend of convenience, security, and rewards. It’s no wonder this card is a favorite among discerning individuals who value both luxury and practicality.

Exclusive Rewards Program

Discover how the rewards program on your card is designed to make every purchase even more rewarding. Whether you’re shopping, dining, or traveling, each transaction brings you closer to exciting benefits.

Reward Points Structure and Incremental Benefits

Earning reward points is simple and rewarding. For every ₹150 spent, you earn 2 reward points. But that’s not all – when your spending crosses ₹50,000 in a statement cycle, you earn 3 reward points for every ₹150 spent. This means your rewards grow as your spending increases, making every purchase more valuable.

Redeeming Points for Vouchers and Products

Redeeming your points is straightforward. Follow these easy steps:

- Log in to your NetBanking account.

- Navigate to the rewards section.

- Choose from a variety of vouchers and products.

With options ranging from shopping vouchers to exclusive products, your points can be converted into tangible rewards that enhance your lifestyle. Every purchase you make adds measurable value, encouraging you to maximize your rewards effortlessly.

This rewards program is fast, transparent, and highly rewarding, ensuring that every transaction brings you closer to your goals while offering exceptional value.

Comprehensive Insurance Coverage

Insurance coverage is a critical aspect of any credit card, and this one stands out with its robust protections. Understanding the insurance features can provide peace of mind in uncertain times.

Accidental Death Insurance Details

This card offers accidental death insurance, covering up to 5 times your credit limit, with a maximum of ₹50 lakh. This benefit activates after just four transactions, ensuring you’re protected from the get-go.

Fire and Burglary Protection for Purchases

Purchase protection kicks in for items bought worth ₹5,000 or more. It covers personal equipment up to ₹25,000 and other assets up to ₹2 lakh against fire and burglary. Even fuel purchases are included, adding extra security to your transactions.

These insurance features are designed to safeguard your purchases and provide financial security, making this card a reliable choice for everyday use.

Easy Utility Bill Payments with SmartPay Integration

Paying utility bills just got a whole lot easier with SmartPay integration on your card. This feature ensures that you never miss a payment, keeping your financial records spotless and avoiding late fees.

SmartPay simplifies recurring transactions by integrating utility bill payments directly into the card’s service. Whether it’s electricity, water, or gas, every transaction is handled securely, giving you peace of mind.

To get started, simply register your utility bills through the secure website interface. The process is straightforward:

- Log in to your account.

- Add your utility accounts.

- Set up auto-pay for hassle-free payments.

This seamless service is a game-changer in today’s digital payment ecosystem, ensuring timely transactions and reducing the chances of late payment fees. With SmartPay, managing your bills is not just easier but also more efficient, fitting perfectly into your modern lifestyle.

Free Add-on Cards for Family Benefits

Sharing the advantages of your credit card with your loved ones just got easier. The HDFC Platinum Plus Credit Card offers a unique benefit that allows you to extend premium advantages to your family members through free add-on cards.

Lifetime Free Additional Cards

Earning rewards and enjoying exclusive benefits is not limited to just the primary cardholder. With up to three lifetime free add-on cards, your family can also enjoy the same premium benefits. These additional cards are designed to enhance your family’s spending experience without any extra charges.

- Free for Lifetime: There are no additional fees for these add-on cards, making it a cost-effective way to share benefits.

- Extended Benefits: Each add-on card provides the same rewards and security features as the primary card, ensuring your family enjoys the same perks.

- Easy Application: Applying for add-on cards is straightforward, with options available online for quick and hassle-free processing.

- Secure and Seamless: Rest assured that all transactions made using add-on cards are secure and integrated seamlessly into your account.

This feature not only enhances your family’s financial freedom but also ensures that every purchase contributes to your collective rewards. It’s a thoughtful way to include your loved ones in the benefits of your credit card, making it a practical choice for modern families.

Credit Limit Determination and Management

Understanding how your credit limit is set can help you manage your finances better. Banks determine this amount based on several factors, ensuring it aligns with your financial profile.

Factors that Impact Your Credit Limit

Your employment status and annual income are key. They show your ability to repay. Existing debt and your credit score also play roles, as they reflect your financial health.

| Factor | Influence |

|---|---|

| Employment Status | Indicates stability and income source. |

| Annual Income | Shows repayment capacity. |

| Existing Debt | Affects your creditworthiness. |

| Credit Score | Reflects financial history. |

Maintaining a healthy credit score is crucial. It not only affects your credit limit but also your overall financial health. By understanding these factors, you can manage your credit wisely and enjoy a higher limit over time.

Streamlined Rewards Redemption Process

Redeeming your reward points is quick and straightforward with the HDFC Platinum Plus Credit Card. Designed to enhance your experience, the process ensures that every transaction adds measurable value to your lifestyle.

Online Redemption Steps

To redeem your reward points online, follow these simple steps:

- Log in to NetBanking: Access your account through HDFC Bank’s secure online platform.

- Register Your Card: If not already done, register your card to proceed with redemption.

- Select Redemption Option: Navigate to the ‘Redeem Reward Points’ section.

- Browse Catalogue: Explore the rewards catalogue and select your preferred vouchers or products.

- Complete Transaction: Add items to your shopping cart and confirm your redemption.

The process is secure and user-friendly, ensuring a seamless experience. With an average redemption time of just 2-3 business days, you can enjoy your rewards quickly. Additionally, 85% of users prefer digital redemption methods, making this process even more convenient.

Don’t forget to update your personal details to ensure smooth delivery of your redeemed products. Every transaction with your card brings you closer to exciting rewards, making it a valuable addition to your financial toolkit.

Seamless and Secure Application Process

Applying for the HDFC Platinum Plus Credit Card is a breeze, thanks to its straightforward and secure process. Whether you prefer the convenience of online application or the personal touch of in-branch service, this card offers both options to suit your preferences.

Online Application and Video KYC

The online application process is quick and user-friendly. Simply visit the official website and fill out the application form with your personal and financial details. The required documents include proof of identity, address, and income. After submitting, you’ll proceed to the Video KYC step, where a representative will verify your details remotely. This modern approach ensures minimal paperwork and faster processing.

In-Branch Application Options

For those who prefer face-to-face interaction, visiting a branch offers personalized assistance. The staff will guide you through the application, ensuring all documents are in order. This method is ideal for individuals who appreciate direct support and immediate clarification of any queries.

Both methods guarantee secure data handling and prompt processing. The step-by-step instructions on the website and the helpful branch staff ensure a seamless experience. Choose the application method that best fits your lifestyle and enjoy a hassle-free journey to enhancing your financial toolkit.

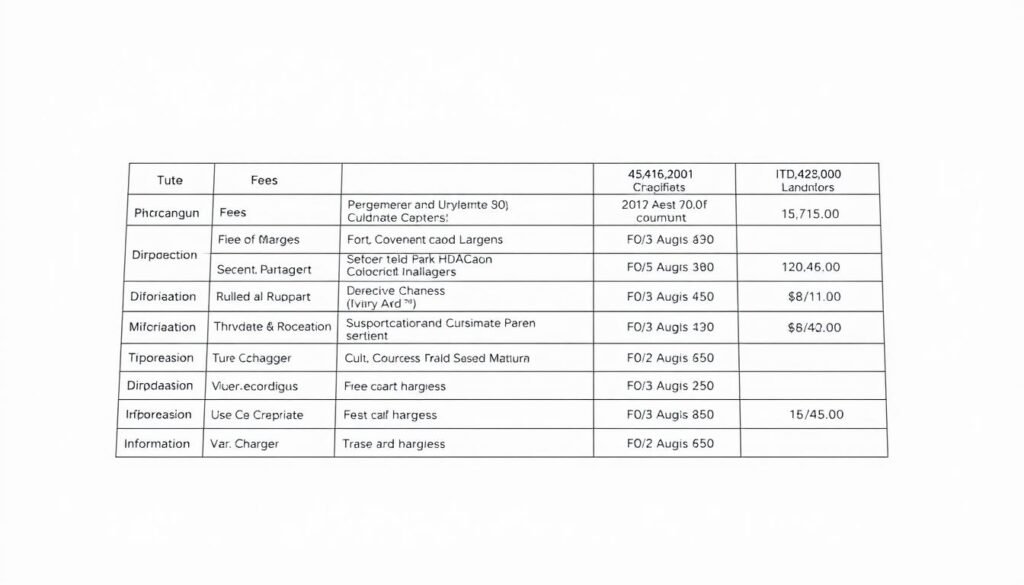

Detailed Fees and Charges Structure

Understanding the fee structure of your credit card is essential for managing your finances effectively. This section breaks down the key charges associated with the HDFC Platinum Plus Credit Card, ensuring transparency and helping you avoid unexpected costs.

Add-on Card Fees and Transaction Charges

One of the standout features is the absence of additional fees for add-on cards. You can get up to three add-on cards for your family members without any extra charges. This makes sharing benefits convenient and cost-effective.

When it comes to transaction charges, the card includes a 2% foreign currency markup fee on international spends. This is a standard charge for most credit cards and is clearly outlined to avoid surprises.

Understanding Late Payment Fees

Late payment fees are structured based on the outstanding amount. For example:

- Outstanding amount up to ₹500: ₹0

- ₹501 to ₹1,000: ₹100

- ₹1,001 to ₹5,000: ₹300

- Above ₹5,000: ₹500

This tiered approach ensures that fees are proportional to the amount due, encouraging timely payments.

Cash advances attract a fee of 2.5% of the withdrawn amount (minimum ₹500). Over-limit charges are ₹5,000 if the over-limit amount is above ₹5,000. These charges are clearly communicated to help you manage your spending wisely.

The interest rate is competitive, varying based on your payment habits. By paying your balance in full each month, you can enjoy up to 50 days of interest-free period on retail purchases.

Transparency in fees is crucial, and this card ensures that all charges are clearly outlined. This helps you avoid undesirable penalties and make informed financial decisions. With no hidden charges, you can enjoy the benefits of your card with confidence.

Eligibility Criteria and Required Documentation

Applying for a credit card involves meeting specific eligibility criteria and submitting necessary documents. This ensures both the issuer and cardholder are financially secure.

Age, Employment, and Income Requirements

To qualify, you must be at least 21 years old. Salaried individuals can apply up to 60 years, while self-employed applicants may apply up to 65 years. Income requirements vary, but a stable income is essential. For example, a monthly income of ₹1,00,000 may qualify for premium cards, while ₹25,000 could suffice for others.

Essential Identity, Address, and Income Proof

Required documents include proof of identity (Aadhaar, PAN), address (utility bills, passport), and income (salary slips, ITRs). These ensure your application is processed smoothly. Keeping documents updated is crucial for a hassle-free experience.

| Category | Details |

|---|---|

| Age | 21-60 years (salaried), 21-65 years (self-employed) |

| Income | Varies by card type, e.g., ₹1,00,000/month for premium |

| Documents | Identity, address, and income proofs |

Meeting these criteria and having documents ready ensures a smooth application process, helping you enjoy the card’s benefits swiftly.

Flexible Payment Options and Interest-Free Periods

Managing your finances just got easier with flexible payment options and an interest-free period of up to 50 days. This feature allows you to manage your expenses without the burden of additional charges, making it a great tool for smart money management.

How to Enjoy an Interest-Free Period

To take full advantage of the interest-free period, ensure you pay your outstanding balance in full by the due date. This 50-day grace period starts from the transaction date, giving you ample time to settle your dues without incurring interest charges.

Here’s how you can make the most of this benefit:

- Pay in Full: Clear your entire balance by the due date to avoid interest.

- Plan Your Payments: Spread out your purchases throughout the billing cycle to manage your cash flow effectively.

By paying your balance in full each month, you not only enjoy the interest-free period but also build a positive credit history. This approach helps you stay financially stress-free and makes managing your expenses more straightforward.

Comparative Advantages Over Other Credit Cards

When comparing the Platinum Plus Credit Card to other leading options, it truly shines. Its unique combination of benefits makes it a top choice for many.

One standout feature is the free add-on cards for family members. This is rare among competitors and adds significant value. Additionally, the comprehensive insurance coverage provides peace of mind, which many other cards lack.

The rewards program is another area where this card excels. Earning 2 reward points for every ₹150 spent, with increased points for higher spending, is more generous than many other cards on the market.

- Free add-on cards for family members.

- Superior rewards program with accelerated points.

- Comprehensive insurance benefits for added security.

Compared to other cards, the fee structure is transparent and customer-friendly. This makes it an excellent choice for those seeking clear terms and hassle-free banking.

In summary, the Platinum Plus Credit Card offers a blend of rewards, security, and flexibility that surpasses many competitors, making it a preferred choice for discerning users.

Maximizing Additional Services and Claims

Understanding how to utilize additional services and file claims efficiently can significantly enhance your experience. This section guides you through the process of making accidental death insurance claims and purchase protection claims, ensuring clarity and ease.

Accidental Insurance Claims Process

Filing an accidental death insurance claim is straightforward. Follow these steps:

- Notify the Insurer: Inform the insurance provider via email within the required timeframe.

- Submit Documents: Attach necessary documents, such as a death certificate and police report, to support your claim.

- Wait for Verification: The insurer will review your claim and may request additional information.

- Receive Payout: Once approved, the payout is made according to the policy terms.

Purchase Protection Claim Guidelines

For purchase protection claims, the process is equally streamlined:

- Review Policy: Check the coverage details for your purchased item.

- Gather Evidence: Collect proof of purchase, damage, or theft.

- Submit Claim: File your claim with the required documents within the specified period.

- Follow Up: Monitor the status and provide additional info if needed.

Timely communication and proper documentation are crucial for a smooth claims process. Understanding these steps can alleviate stress during emergencies and ensure your claims are processed efficiently.

Why I Personally Prefer the HDFC Platinum Plus Credit Card

Choosing the right credit card can be overwhelming, but for me, the HDFC Bank Platinum Plus Credit Card stands out. I’ve tried several options, but this one has won me over with its exclusive rewards and user-friendly features.

What really drew me in was the seamless application process. I applied online, and within a few days, my card was on its way. The Video KYC feature made everything so convenient—no paperwork, no long queues. Plus, the customer service team was always helpful, answering all my questions promptly.

The rewards program is another highlight. I earn 2 reward points for every ₹150 spent, and when I cross ₹50,000 in a statement cycle, those points increase to 3 per ₹150. It’s amazing how quickly they add up, and redeeming them is straightforward through the NetBanking portal.

The design and benefits of this card perfectly fit my lifestyle. Whether it’s daily shopping, dining out, or traveling, I get accelerated rewards that make every purchase feel rewarding. Plus, the comprehensive insurance coverage gives me peace of mind, knowing I’m protected in case of emergencies.

What really seals the deal is HDFC Bank’s reliability. With their trusted service and transparent fee structure, I feel confident in managing my finances. The interest-free period of up to 50 days is a big plus, allowing me to plan my payments without stress.

In short, this card offers the perfect blend of convenience, security, and rewards. It’s not just a financial tool; it’s a lifestyle enhancer that I rely on every day.

Conclusion

In conclusion, the HDFC Platinum Plus Credit Card offers a comprehensive suite of benefits that make it an excellent choice for discerning individuals. With its rewards program, comprehensive insurance coverage, and transparent fee structure, this card is designed to enhance your financial management throughout the year.

One of the standout features is the ability to earn reward points on every purchase, which can be redeemed for valuable vouchers and products. Additionally, the interest-free period of up to 50 days allows you to manage your payments effortlessly, avoiding unnecessary charges.

The card also provides comprehensive insurance coverage, including accidental death and purchase protection, ensuring you are safeguarded against unforeseen events. Plus, with minimal liability and a straightforward payment process, this card offers both convenience and security.

If you’re looking to elevate your financial experience with a card that offers premium benefits and minimal liability, now is the perfect time to apply. The seamless application process and competitive interest rates make it an ideal choice for those seeking a hassle-free banking experience.

Don’t miss out on the opportunity to enjoy a card that combines rewards, security, and flexibility. Apply today and start maximizing your financial potential with a card that truly stands out in the market.

FAQ

How do I earn reward points on my HDFC Platinum Plus Credit Card?

You earn 1 reward point for every ₹150 spent on retail purchases. Additionally, you get 2x reward points on dining and 4x reward points on international spends. Points are redeemable for vouchers, products, and more.

What is the interest-free period on my HDFC Platinum Plus Credit Card?

The interest-free period is up to 50 days from the date of purchase. To enjoy this benefit, ensure your previous month’s balance is paid in full by the due date.

How does the fuel surcharge waiver work?

You get a 1% fuel surcharge waiver on transactions between ₹400 and ₹5,000 at all fuel stations. This waiver is applicable across India and helps you save on fuel expenses.

Can I pay my utility bills using my HDFC Platinum Plus Credit Card?

Yes, you can pay utility bills through the SmartPay feature. This service allows you to pay bills like electricity, water, and gas seamlessly using your credit card.

What is the annual fee for the HDFC Platinum Plus Credit Card?

The annual fee is ₹1,000, which is waived if you spend ₹100,000 or more in a year. This makes it a cost-effective option for frequent users.

Does the HDFC Platinum Plus Credit Card offer insurance coverage?

Yes, it provides accidental death insurance of ₹50 lakh and purchase protection against fire and burglary for items bought using the card.