Did you know that over 70% of credit card users in India are looking for rewards that match their lifestyle? The HDFC Titanium Edge Credit Card is here to change how you think about everyday spending. Designed with the modern spender in mind, this card offers reward points on every transaction, making it a standout choice for those who want to maximize their benefits.

What makes the HDFC Titanium Edge Credit Card truly special is its 1% fuel surcharge waiver on all fuel transactions across India. Plus, with no joining fee and a spend-based renewal fee waiver, it’s an accessible option for everyone. Whether you’re filling up at the pump or shopping online, this card ensures you earn reward points every step of the way.

I personally love how this card combines simplicity with value. The 3.49% monthly interest rate is competitive, and the zero liability feature gives me peace of mind. With benefits like these, it’s no wonder the HDFC Titanium Edge Credit Card has become a favorite among savvy spenders.

Key Takeaways

- Earn reward points on every transaction with the HDFC Titanium Edge Credit Card.

- Enjoy a 1% fuel surcharge waiver at all Indian fuel stations.

- No joining fee and spend-based renewal fee waiver.

- Competitive 3.49% monthly interest rate.

- Zero liability feature for lost cards.

- Simple and accessible for users across India.

Overview of the HDFC Titanium Edge Credit Card

Discover how the HDFC Titanium Edge Credit Card is redefining everyday spending with its attractive reward structure and user-friendly benefits. Designed to cater to diverse lifestyles, this card ensures that every transaction brings you closer to unlocking exciting rewards.

One of the standout features is the zero joining fee and the spend-based renewal fee waiver. This makes it accessible to a wide range of users. Whether you’re dining out or filling up your tank, the card offers enhanced reward points on dining and a 1% fuel surcharge waiver, ensuring maximum savings.

I personally appreciate the simplicity and value this card provides. The competitive interest rate and zero liability feature offer peace of mind. With these benefits, it’s no wonder this card is a favorite among discerning spenders in India.

Why I Chose This Card

The combination of reward points on every transaction and practical benefits makes this card a standout choice. The enhanced dining rewards and convenient fee structure align perfectly with my lifestyle, making it an essential tool for maximizing everyday spending.

Key Features and Reward Benefits

Understanding the features of the Titanium Edge Credit Card is essential to maximizing its benefits. This card is designed to reward your everyday spending in a structured manner, ensuring you get the most out of every transaction.

Reward Points and Redemption Options

Earning reward points is straightforward. For every Rs. 150 spent, you earn 2 reward points. Dining transactions offer an additional 50% more points, making them even more rewarding. These points can be redeemed for cash credit, though a nominal fee of Rs. 99 applies per redemption. The points remain valid for two years, giving you ample time to accumulate and redeem them.

Fuel Surcharge Waiver and Other Perks

A standout feature is the 1% fuel surcharge waiver, applicable on transactions between Rs. 400 and Rs. 5,000. This waiver is capped at Rs. 250 per billing cycle, providing significant savings on fuel expenses. Additionally, cardholders enjoy benefits like accidental death insurance coverage of up to Rs. 50 lakh, adding a layer of security.

- Earn 2 reward points on every Rs. 150 spent, with 50% more points on dining.

- Redeem points for cash credit with a Rs. 99 fee per redemption.

- Enjoy a 1% fuel surcharge waiver, capped at Rs. 250 per cycle.

- Benefit from accidental death insurance up to Rs. 50 lakh.

These features make the Titanium Edge Credit Card a practical choice for those seeking both rewards and convenience in their daily spending.

Eligibility, Application Process, and Documentation

To apply for the Titanium Edge Credit Card, you’ll need to meet specific eligibility criteria and gather the necessary documents. Let’s break it down step by step.

Eligibility Criteria and Age Requirements

The eligibility criteria are straightforward. Salaried individuals must be between 21 and 60 years old, while self-employed applicants can be between 21 and 65 years old. A good credit history is also essential for approval.

Documents Required for Application

You’ll need the following documents:

- Identity proof (Aadhaar, Driving License, Voter ID, or Passport)

- Address proof (Aadhaar, Driving License, Voter ID, or Passport)

- PAN card

- Income proof (bank statements, salary slips, or ITR for self-employed)

The application process is simple. You can apply online through HDFC Bank’s website or visit a branch. Ensure all documents are complete to avoid delays. I always double-check my documents before submitting to make the process smoother.

| Category | Details | Requirements |

|---|---|---|

| Age | Salaried | 21-60 years |

| Age | Self-Employed | 21-65 years |

| Documents | Identity & Address Proof | Aadhaar, Driving License, Voter ID, or Passport |

| Financial | Income Proof | Bank statements, salary slips, or ITR |

Meeting these criteria and having your documents in order ensures a smooth application process. Proper documentation is key to a hassle-free experience, so it’s worth taking the time to get everything ready before applying.

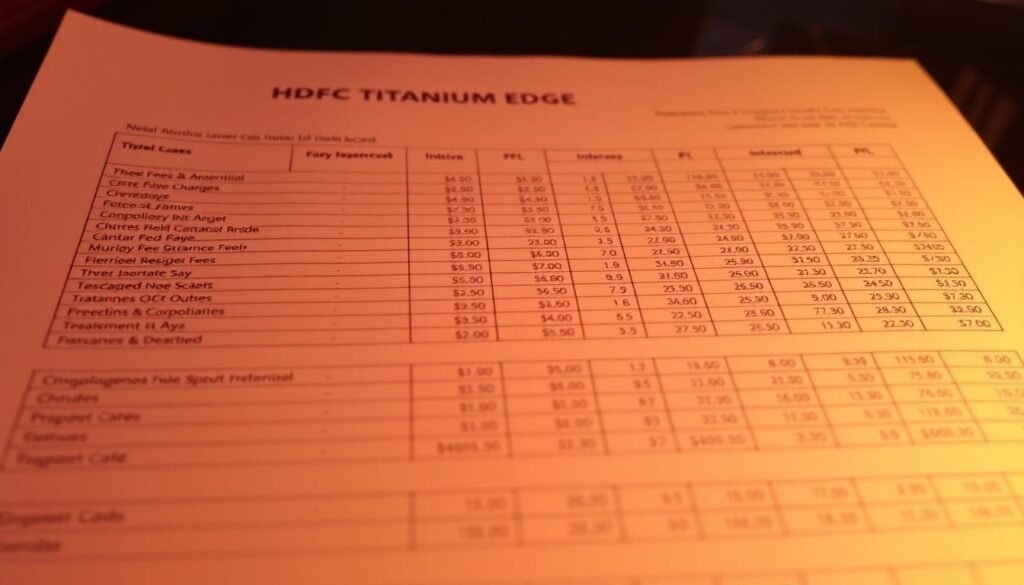

Analysis of Fees, Charges, and Interest Rates

Understanding the fee structure of the Titanium Edge Credit Card is crucial for maximizing its benefits. This card stands out with no joining fee, making it accessible from the start. The annual fee, however, can be waived if you spend Rs. 50,000 in a year, ensuring it remains cost-effective for regular users.

Annual Fee and Spend-Based Waiver Details

The annual fee waiver is a significant advantage. By meeting the spend requirement, you effectively eliminate this cost, making the card even more appealing for those who use it frequently. This feature is particularly beneficial for long-term use, as it reduces overall expenses over time.

Interest Rate and Additional Charges

The card charges an interest rate of 3.49% per month, which is competitive and reasonable for a credit card. Additional charges include a cash advance fee and a foreign currency markup. These charges are standard but should be considered in your spending habits to avoid unnecessary costs.

- No joining fee.

- Annual fee waiver on spending Rs. 50,000 annually.

- 3.49% monthly interest rate.

- Cash advance fee and foreign currency markup apply.

Personally, I find the fee structure transparent and fair compared to other cards. It offers a good balance between costs and benefits, especially with the annual fee waiver. For someone mindful of expenses, this card is a smart choice due to its clear and manageable charge structure.

Conclusion

My experience with the Titanium Edge Credit Card has been nothing short of delightful. It’s the perfect blend of simplicity and value, making everyday spending more rewarding. With reward points on every transaction and a 1% fuel surcharge waiver, it’s designed to maximize your benefits without any hassle.

The spend-based renewal fee waiver is a standout feature, ensuring the card remains accessible for everyone. Plus, with no joining fee, it’s an excellent choice for those starting their credit journey. The competitive interest rate and zero liability feature add to its appeal, offering both affordability and peace of mind.

While it may not offer all the exclusive privileges of premium cards, the Titanium Edge Credit Card is a great entry point for anyone seeking a balance between budget-friendliness and premium rewards. Its transparent fee structure and ease of use make it a reliable companion for everyday transactions.

If you’re looking for a card that combines simplicity, transparency, and value, this is an excellent choice. It’s perfect for those who want to earn rewards without the complexity, making it a smart pick for budget-minded individuals who still appreciate premium benefits.

FAQ

How do I earn reward points on my card?

You earn reward points on every purchase, with accelerated rewards on dining and fuel transactions. Every ₹150 spent gives you 1 reward point, which can be redeemed for travel, merchandise, or statement credits.

What is the fuel surcharge waiver benefit?

The fuel surcharge waiver saves you up to 1% on fuel transactions at any petrol pump. This benefit is capped at ₹500 per month, making it a great perk for frequent drivers.

What is the annual fee, and can it be waived?

The annual fee is ₹500. It can be waived if you spend ₹50,000 or more in a year, making it a cost-effective option for regular users.

What are the eligibility criteria for this card?

You must be at least 21 years old and meet the income requirements set by HDFC Bank. Additionally, you’ll need to provide valid documentation like PAN, Aadhaar, and income proof during the application process.

How does the interest rate work?

The interest rate varies between 3.40% to 3.50% per month, depending on your payment history and bank policies. It’s important to pay your balance in full each month to avoid interest charges.

Does this card offer any insurance benefits?

Yes, it includes insurance benefits like accidental death coverage and purchase protection. These features add an extra layer of security to your purchases and travels.

Can I use this card internationally?

Absolutely! This card is accepted worldwide and supports international transactions. However, a small foreign currency markup fee applies to overseas purchases.

How do I apply for this card?

You can apply online through HDFC Bank’s website or visit a nearby branch. The process is quick and requires minimal documentation, making it hassle-free for most applicants.

What are the joining fees?

There’s no joining fee for this card, making it even more accessible for first-time credit card users.